If you follow our blog (and we know you do), you’ve probably detected a theme over the last few days: global pharma compliance. We’ve written about Russia Chestny ZNAK, United Arab Emirates Tatmeen, Uzbekistan ASL BELGISI, and our rfxcel DSCSA Compliance Library. Today, we’re looking at the Egypt pharmaceutical supply chain. Let’s get started.

Notable news about the Egypt pharmaceutical supply chain

Last August, Egyptian Prime Minister Mostafa Madbouli told a gathering of government officials that the country would prioritize the “localization” of the pharma industry. He said President Abdel Fattah al-Sisi had tasked the government with developing an executive plan to this end.

It seems to be working: the Egypt pharmaceutical supply chain is enjoying strong growth. Last month, Egyptian Drug Authority (EDA) Director Dr. Tamer Essam said the country’s pharma exports had risen to 35 percent, an all-time high. “There is no medicine in the world or vaccine that is not manufactured in Egypt,” he said. In February 2021, the EDA announced it was launching an export subsidy initiative and had begun reviewing and updating all export procedures to ensure they complied with global regulatory requirements.

In April 2021, the head of the General Division of Drug Traders at the Federation of Egyptian Chambers of Commerce (FEDCOC), Ali Auf, said Egypt produced about 85 percent of its pharmaceutical needs domestically (and imported only 15 percent).

Auf made these statements two days after President Sisi inaugurated Gypto Pharma City, which embodies Egypt’s drive for pharmaceutical self-sufficiency. Situated on roughly 44.5 acres in Khanka, about 20 miles from Cairo, it’s one of the largest “medicine cities” in the region. It has facilities for production, administration, industrial services, and networks.

Egypt envisions Gypto Pharma City as a regional hub for the international pharmaceutical and vaccine industries, calling it “one of the most important national projects … with the aim of possessing the modern technological and industrial capacity in this vital field.”

The Egyptian Pharmaceutical Track & Trace System

The goal of the Egyptian Pharmaceutical Track & Trace System (EPTTS) is end-to-end traceability and product authentication across the Egypt pharmaceutical supply chain to reduce counterfeits, increase efficiency, and protect consumers. Appropriately, this dovetails into what the government has said about Gypto Pharma City — that it will “help citizens obtain high-quality and safe pharmacological treatment, end monopolistic practices, and control the prices of medicines.”

At first, the Ministry of Health and Population managed EPTTS; however, Law No. 151 of August 2019 essentially transferred those duties to the newly formed EDA. (It also created another organization, the Egyptian Authority for Unified Drug Procurement, a “centralized procurement and supply interface.”) The EDA was initially affiliated to the prime minister, but Presidential Decree 18/2020 of January 2020 gave it more autonomy.

The EDA “inherited” three organizations from the Ministry of Health and Population:

- The Central Administration of Pharmaceutical Affairs (CAPA) registers pharma products, issues licenses for the establishment of pharma entities, and licenses the import and export of pharma products. It’s also responsible for regulating prices and evaluating clinical trials and studies of drugs.

- The National Organization for Drug Control and Research (NODCAR) works to ensure the quality, safety, and effectiveness of pharma products, cosmetics, and insecticides. NODCAR must certify every pharmaceutical product before it can be registered, marketed, advertised, distributed, imported, or exported.

- The National Organization for Research and Control of Biologicals (NORCB) monitors, inspects, and releases all biological products for human or animal use, such as vaccines.

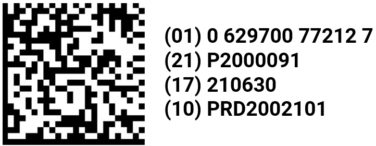

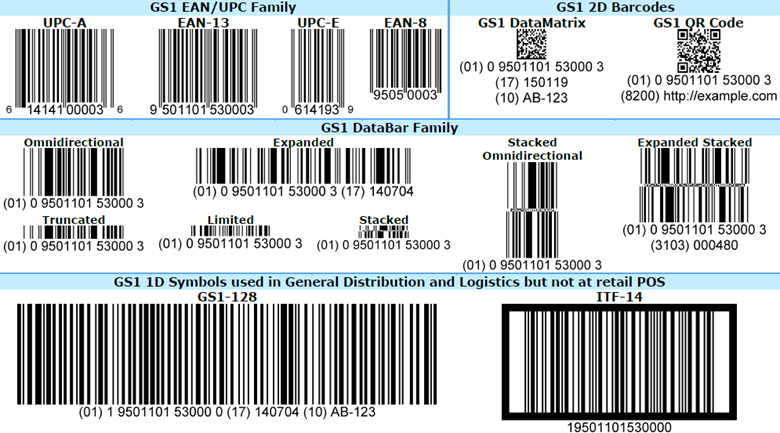

Like most countries, the Egypt pharmaceutical supply chain follows GS1 labeling standards, characterized by Global Trade Item Numbers (GTINs), Serialized Global Trade Item Numbers (SGTINs), 2D DataMatrix codes, GS1-128 barcodes, serial shipping container codes (SSCCs), and Global Location Numbers (GLNs). It is also using GS1’s Electronic Product Code Information Services (EPCIS) standard.

Secondary packaging must be marked with a 2D DataMatrix code with the GTIN, expiry date, batch number, and a randomized serial number. EPTTS’ original plan was to require these data points to be presented in a specific sequence, but this was nixed. Cases and pallets must have a GS1-128 barcode or a DataMatrix code with the SSCC.

EPTTS requires aggregation, including maintaining the parent-child relationship, but has yet to provide details. We’re also waiting for specifics about some aspects of serialization, including if serial numbers can be reused.

For data and compliance reporting, supply chain actors are required to submit data to a GS1 Global Data Synchronization Network (GDSN) database. They must upload photos — as many as six of them — that clearly show the product packaging and other details, including the GTIN, brand name, storage instructions, country of origin, product name, and any warning statement. To date, however, the government hasn’t published specifications for communicating with the EPTTS database.

A pilot to test EPTTS was held from December 1, 2019, to January 12, 2020. Participants have shared feedback, but there hasn’t been much movement since. GS1 Egypt and the EDA are apparently still working on the implementation guidelines, which are now in their third iteration.

Final thoughts

The Egypt pharmaceutical supply chain regulations are a work in progress, and we’ll continue to follow developments and share updates when there’s concrete news.

But as we said in our overview of UAE Tatmeen, the global push for pharmaceutical traceability and serialization is continuing at a furious pace. If you’re a manufacturer, a distributor, a third-party logistics provider, a dispenser — any actor in the supply chain — waiting for Egypt or any other country to formalize their regulations is not a wise strategy. You have to have a solution now, preferably one that will work in every country.

That’s what our Traceability System does. Our supply chain experts can demonstrate in a few minutes how it automates compliance and optimizes just about every other aspect of your operations. Contact us today to see it in action. And continue following our blog. We’ll be writing more about global pharma regulations in the coming weeks (and months and years). For example:

- Brazil ANVISA Deadline Is Just Two Weeks Away. Here’s What to Know

- Uzbekistan ASL BELGISI Update: Deadline for Pharma Serialization Extended

- UAE Pharmaceutical Products Traceability Requirements for 2022

- Understanding Africa’s Supply Chain (3-Part Series)

- rfxcel DSCSA Compliance Library: A One-Stop Shop of DSCSA Information