Effective compliance management takes time and effort, but it’s much better to be prepared and prevent problems before they occur. Violating the regulations that govern your industry means you risk losing customers, damaging your reputation, and hurting your bottom line. Fortunately, taking a proactive approach means you can address many of the compliance challenges that companies face. Let’s take a closer look at compliance management systems and their benefits.

What Is Compliance Management?

Companies in any sector must understand and follow the local, state, federal, or international regulations that affect how they do business. Compliance management is the set of tools and procedures that a business uses to ensure they follow the laws that govern its industry. Regulatory requirements may be established by:

- Government entities

- Labor unions

- Trade associations or other industry organizations

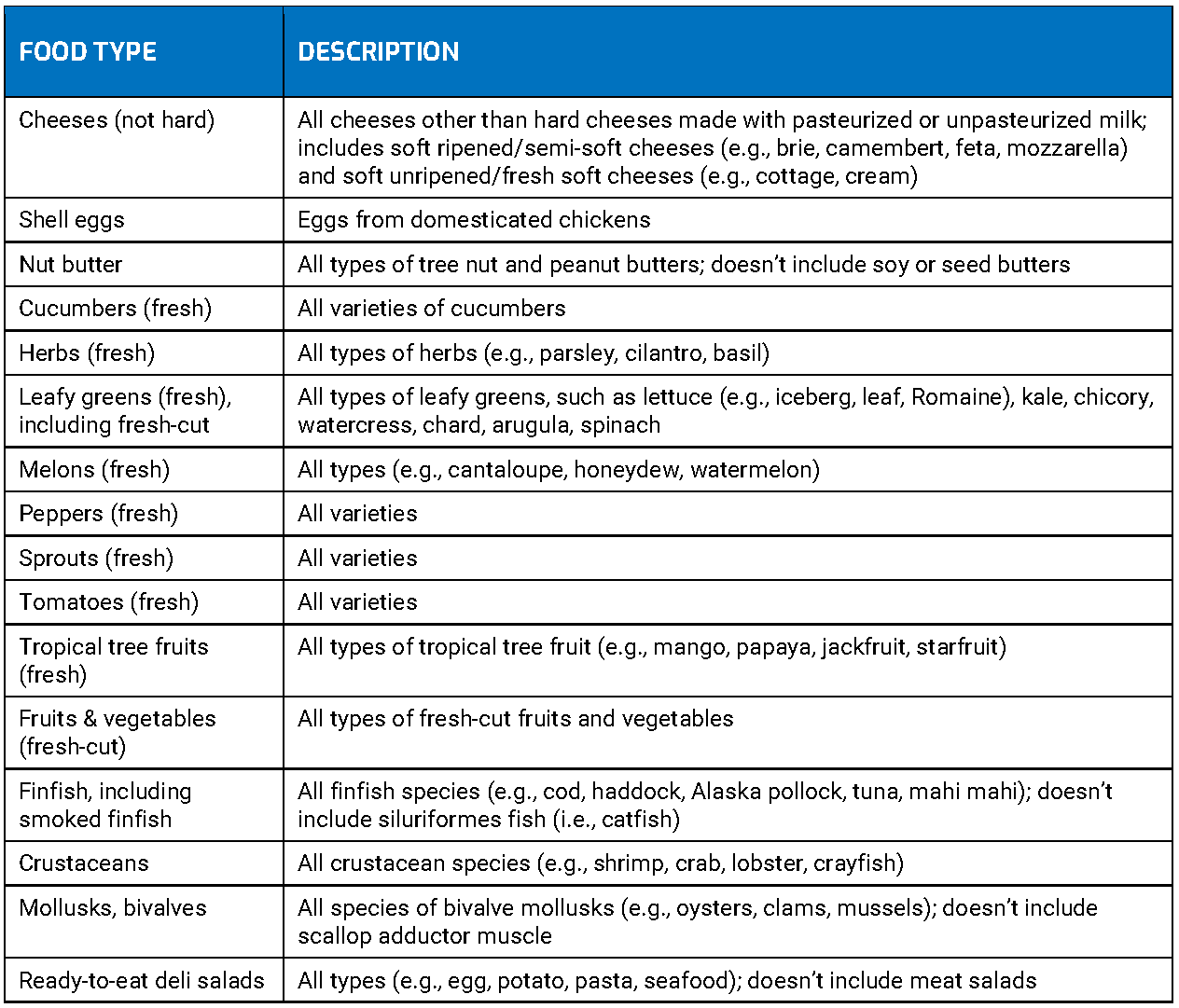

For example, pharmaceutical companies have to comply with the U.S. Drug Supply Chain Security Act (DSCSA), whose requirements include product serialization and electronic, interoperable data exchange. Similarly, the U.S. Food and Drug Administration (FDA) Food Safety Modernization Act (FSMA) has specific requirements for traceability and data-sharing.

Why Is Compliance Management Important?

Compliance requirements are often in place to ensure ethical behavior toward customers or competitors. Clear, enforceable regulations set standards for businesses, governments, and civil society organizations.

Failure to adhere to applicable laws or regulations could result in fines, fees, suspension of business operations, revocation of licenses or certifications, or other compliance issues. Thus, many businesses create and establish governance, risk management, and compliance (GRC) programs to minimize their risk.

Three Approaches to Compliance Management

A compliance management solution can vary from simple to complex and must be uniquely tailored to suit an organization’s structure and industry. Three common methods of compliance management are:

Strict, Top-Down Approach

This is the most rigid approach to compliance management. Internal policies are created and implemented by the person or team at the top of the organizational chart. There is no room for flexibility or interpretation. A top-down model is usually needed when the health, safety, and welfare of employees or the people they serve are paramount. For example, a daycare operator must follow all the state and local regulations created to keep minors safe.

Hands-Off Approach

In contrast, a hands-off approach is the most flexible type of compliance management. In this model, leadership may establish compliance standards, but the implementation of day-to-day business processes is handed off to middle managers or other employees.

This approach can work in certain situations. For example, a franchisor that has retail food establishments in different states may be subject to health department inspections in each state. Recognizing that each franchisee is subject to a different set of regulations, they may leave it up to each site manager to implement training or an inspection checklist at their respective franchise.

Shared or Distributed Model

In this approach, compliance activities are shared by employees across the organization. Instead of receiving strict guidelines from a central authority, departments or teams may share the responsibility of creating and implementing compliance activities. Or, the organization may issue a central policy and solicit feedback from employees on what to change or improve. A distributed model can work especially well when companies are implementing newly issued regulations and need feedback from staff on the front lines of their industry.

Compliance Management Challenges

Thoughtful, proactive implementation of compliance measures helps save time and money down the line. But compliance management is not without its challenges, which can include:

- Evolving regulatory landscape: Whether you’re a startup or a multinational corporation, keeping up with new and changing regulations can be difficult. In an increasingly complex corporate environment, it makes sense that organizations may struggle to stay up to date.

- Changing working environments: In recent years, more and more businesses have embraced a hybrid work model. While letting employees work from anywhere can help organizations stay nimble, it also exposes them to a new set of cybersecurity risks and HR challenges.

- Vendor management: You can’t be an expert in everything. Understandably, businesses often partner with third-party vendors for certain services, whether it’s benefits management, IT support, or legal services. Improper vetting or insufficient due diligence can mean that you end up working with vendors that are out of compliance with your industry requirements.

Pharmaceutical, Food and Beverage, and Cosmetics

Companies in the pharmaceutical, food, and beverage, and cosmetics industries face unique challenges when it comes to compliance management. Consumers need to know that the food they eat, the medicine they take, and the personal care products they use are safe.

Pharmaceutical compliance regulations such as the U.S. DSCSA and the EU Falsified Medicines Directive (EU FMD) are in place to improve patient safety, ensure product integrity, and keep counterfeit drugs out of the supply chain. For the food industry, the Food Safety Modernization Act (FSMA) and guidelines like the Global Food Safety Initiative (GFSI), are in place to make the food supply safer and reduce rates of foodborne illness. Regulations for cosmetics vary widely from country to country, but generally, companies must take steps to ensure their products are safe, have complete ingredient labels, and they can verify their labeling claims.

Throughout all these industries, regulatory bodies are increasingly looking to improve supply chain transparency and traceability.

Compliance Management Best Practices

Companies can support regulatory compliance through best practices such as:

- Thorough documentation: When in doubt, document everything, even if it’s not mandated by law. A central document repository makes it easy for employees across the organization to find the information they need and prevent non-compliance.

- Set data standards: Be sure that you’re meeting the industry standards for high-quality data across all business operations. Inaccurate or incomplete data means you’ll be less prepared for accurate compliance reporting.

- Education and engagement: Know your industry inside and out. Staying connected with industry associations, participating in continuing education, and attending events and conferences helps the organization stay up to date on industry changes and trends.

How to Create a Compliance Management Program

Whether you’re implementing compliance management at a new business or overhauling an existing compliance program, these steps are critical:

Conduct a Thorough Risk Assessment

Start by assessing internal and external risks that could affect regulatory compliance. Review each department to identify and document potential issues and to collect qualitative and quantitative data that you can compare against regulatory standards.

Establish Corporate Policies and Procedures

Look to industry guidance to help you create an initial draft of your compliance policy. You’ll likely need input from stakeholders across the organization, including IT, HR, legal, financial, and risk management leaders. If you don’t already have a compliance officer in place, you’ll need to appoint (or hire) one.

Communicate the Plan and Provide Training

Once your organization has a final compliance policy, it must be communicated to all staff and board officers. Set aside time for dedicated training on the policy, how to use a compliance checklist, and how to conduct an internal audit. Make sure all staff is familiar with any regulatory changes or new rules for recordkeeping and reporting.

Account for Routine Maintenance

Schedule regular reviews of your organization’s compliance policy to ensure it reflects changes in your industry or business operations. Budget the resources to help your compliance team stay abreast of changes in the industry and new regulations.

Conduct Periodic Compliance Audits

Routine internal audits can help identify potential issues before they snowball. Plus, periodic audits ensure your company is better prepared to respond to inquiries from government or regulatory bodies. If violations or vulnerabilities are discovered through an internal audit, take remediation steps immediately and review existing policies to see if there’s a way to prevent similar problems in the future.

Compliance Management Solutions

In addition to a set of internal procedures, a compliance management solution should include:

- Auditing tools

- Ongoing compliance training and education for staff

- Board and management oversight

Additionally, workflow tools and apps can help organize compliance processes and automate certain tasks, like data analysis.

Compliance Management Systems

Today, many organizations rely on digital tools to streamline their compliance efforts. A well-designed compliance management system (CMS) can:

- Improve data quality and business analytics

- Ensure consistency across multiple business locations or branches

- Make tracking, traceability, and reporting easier

- Automate routine tasks so employees can focus on other business priorities

- Minimize an organization’s overall risk exposure

Compliance Management Software

Compliance management software offers a central platform for communicating, overseeing, and documenting compliance activities across an enterprise. We’re committed to improving compliance management through supply chain transparency. With our tailored industry solutions, you can track your supply chain in real-time, no matter where your business is located. rfxcel serves businesses in the pharmaceutical, food and beverage, and consumer goods industries around the world. To learn more about our compliance software solutions or schedule a demo, contact us today.