AVG Chairman & Co-CEO Emidio Zorzella says the acquisition will allow Antares Vision Group to enter the multi-billion-dollar returnable asset management market.

Reno, Nevada, Feb. 15, 2022 (EINPRESSWIRE). Antares Vision Group (AVG), a leading global provider of hardware and software track and trace solutions and one of the major players in inspection systems and smart data management, today announced that it had acquired ACSIS Inc. through its fully controlled company rfxcel for an enterprise value of $12 million.

Founded in 1996, ACSIS has been providing solutions and services to Fortune 1000 manufacturing companies with some of the most complex and highly regulated supply chains in the world for more than 20 years. It delivers innovative software solutions and services to companies with complex warehouse, distribution, and packaging challenges, assists with their data collection requirements for track and trace and inventory optimization through their supply chains, and delivers seamless integration of information to their ERP systems. ACSIS has had zero churn among its Top 10 customers, which include DuPont, Cintas, BIMBO, Hershey and Coca-Cola. AVG will retain ACSIS’ highly experienced and proven executive team.

“The ACSIS acquisition will further strengthen our unique end-to-end solution for the digital supply chain,” rfxcel CEO Glenn Abood said. “It will provide new customers and allow us to enter into new industry verticals, as well as into the relevant returnable asset management market, extending our presence in the United States.”

ACSIS CEO Jeremy Coote said the acquisition brought together industry-leading organizations and technologies. “For more than 20 years, our incredibly talented team has been at the forefront of creating some of the most sophisticated supply chain visibility solutions for manufacturing companies around the world,” he said. “The combination of Antares Vision Group’s world-class talent with ACSIS technology, domain expertise, and commitment to innovating supply chain ecosystems will help ensure our success in an increasingly competitive industry.”

With its deep domain expertise in data collection and serialization, ACSIS in 2019 launched the ACSIS Cloud Platform, a next-generation cloud-based supply chain visibility platform that spans data collection to business process to real-time analytics and uniquely enables personalized, private supply chain edge ecosystems. The ACSIS Cloud Platform solves the toughest supply chain visibility challenges, including:

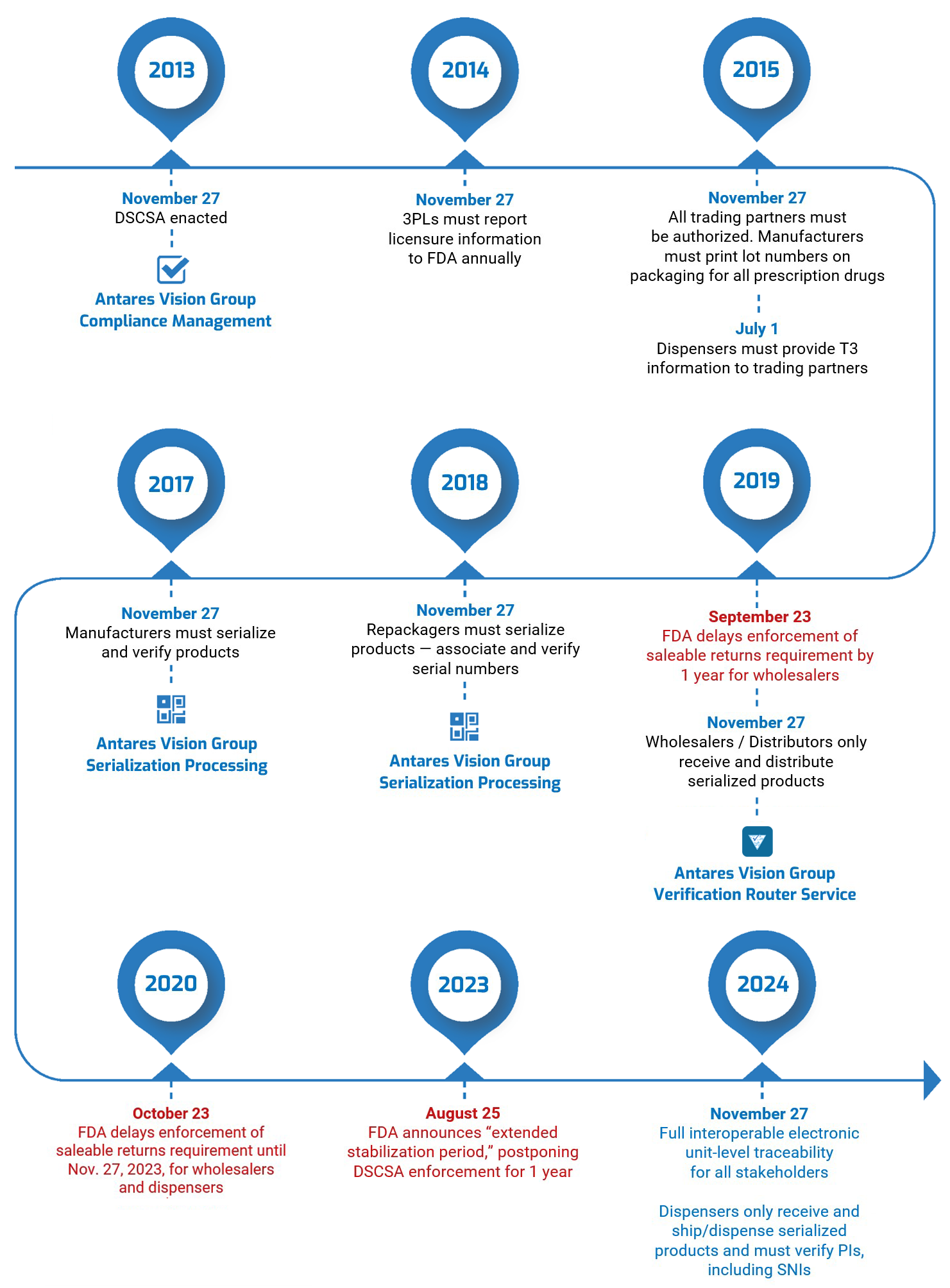

Product traceability: item-level tracking using serialization, barcodes, RFID, and other sensors; edge data collection; visibility across multi-partner ecosystems to ensure regulatory compliance, improve public safety, and enable sustainable supply chains

Returnable asset management: tracks returnable transport items (RTIs) across the extended supply chain in real time to deliver accurate inventory status; ensures compliance and efficiency; controls shrinkage and ensures proper maintenance and inspection of RTIs; predicts demand to support improved planning and customer service

Partner collaboration: integrates with partners across operating ecosystems; delivers real-time supply chain and production visibility; creates more transparent and agile supply chains; maintains common enterprise standards; ensures consistent serialization data and uniform product labeling

About Antares Vision Group

Antares Vision Group is an outstanding technology partner in digitalization and innovation for enterprises and institutions, guaranteeing the safety of products and people, business competitiveness, and environmental protection. Antares Vision Group is a technological enabler of supply chain transparency and sustainable transition to protect business competitiveness and the uniqueness of each country. It provides a unique and comprehensive ecosystem of technologies to guarantee product quality (inspection systems and equipment) and end-to-end product traceability (from raw materials and production to distribution to the consumer), with integrated data, production and supply chain management, also achieved through the application of artificial intelligence and the use of blockchains.

Antares Vision Group is active in the life sciences sector (pharmaceutical, biomedical devices, and hospitals), in the beverage, food, and cosmetics industries, and has potential in other sectors. The world leader in track and trace systems for pharmaceutical products, it provides major global manufacturers (more than 50 percent of the Top 20 multinationals) and numerous government authorities with solutions to monitor their supply chains and validate product authenticity.

Listed since April 2019 on the Italian Stock Exchange in the Alternative Investment Market (AIM) segment and from May 14, 2021, in the STAR segment of the Mercato Telematico Azionario (MTA) (electronic equity market), Antares Vision Group recorded a turnover of Euro 162 million in 2020, operates in 60 countries, employs approximately 1,000 people, and has a consolidated network of more than 40 international partners. For more information, visit antaresvision.com and antaresvisiongroup.com.

About rfxcel

Part of Antares Vision Group, rfxcel has a long history of providing leading-edge software solutions to help companies build and manage their digital supply chain, lower costs, protect their products and brand reputations, and engage consumers. Blue-chip organizations in the life sciences (pharmaceuticals and medical devices), food and beverage, worldwide government, and consumer goods industries trust rfxcel’s Traceability System to power end-to-end supply chain solutions in track and trace, environmental monitoring, regulatory compliance, serialization, and visibility. Founded in 2003, the company is headquartered in the United States.