Indonesia track and trace regulations are designed to prevent counterfeit, stolen, contaminated, or otherwise harmful drugs from entering the supply chain. The goal is to protect consumers and increase patient safety, as well as boost Indonesia’s competitiveness in the pharma global pharma industry.

The National Agency of Drug and Food Control (BPOM) began rolling out regulations in 2018. In 2022, it established provisions and procedures for implementing 2D DataMatrix codes for drug and food products. The country’s digital platform is called the Track and Trace Anti-Counterfeit (TTAC) system.

Key regulations went into effect in 2023; the next big deadlines are set for 2025 and 2027. So let’s take a closer look at Indonesia track and trace regulations and what they mean for the pharma industry.

Indonesia’s Pharma Market in Context

At the time of writing, Indonesia’s population is approaching 279 million — the fourth largest in the world. It’s no surprise, then, that the sprawling archipelago is the largest pharmaceutical market in Southeast Asia.

According to Business Indonesia, sales of medicines in 2020 were valued at about $7.6 billion (110.6 trillion rupiah); this is expected to increase to more than $11 billion (176 trillion rupiah) by 2025. In terms of U.S. dollars, this equates to a compound annual growth rate of 10.7 percent.

Furthermore, the Indonesian government is making significant investments in the country’s healthcare system. The same Business Indonesia article reported that healthcare spending in 2022 accounted for 9.4 percent of the total government budget.

In this context, Indonesia is seeking to expand and open its pharmaceutical sector to foreign participation and investment. Pharma companies that already have an in-country presence or that want to enter the market must fully understand — and comply with — Indonesia track and trace regulations.

The Framework of Indonesia Track and Trace Regulations

Most of today’s global pharma compliance requirements have a few things in common:

- Companies must register products with a country’s regulatory body.

- Companies must send compliance information to a centralized system (e.g., a portal or website like Indonesia’s TTAC).

- Products must be labeled in a manner that identifies them at the unit level (i.e., serialization) and/or a “higher” level, such as a pallet or case (i.e., aggregation).

- Regulators prefer GS1 labeling standards [e.g., 2D DataMatrix codes, Global Trade Item Numbers (GTINs), and Serial Shipping Container Codes (SSCCs)]. Read our “Understanding GS1 Barcodes in the Global Supply Chain” article for a comprehensive overview of these standards.

Indonesia track and trace regulations follow this basic framework:

Registration

Imported and locally produced medicines must be registered with the BPOM before they can be distributed. Pharma companies must have a local business agent or partner to register products, and it’s advisable to obtain all permissions before exporting products to Indonesia.

Labeling

The BPOM requires all medicines sold in Indonesia to be labeled for identification, and upcoming regulations will further require products to be labeled for authentication. The BPOM uses GS1 standards.

Identification Barcodes

Starting on December 7, 2023, traditional medicines and over-the-counter drugs — as well as cosmetics, supplements, processed foods, and some raw materials — were required to be labeled with a QR code that identifies the product in the market and verifies that it’s legal. For products that do not have to be serialized, this is the only marking required.

Identification codes must contain a Marketing Authorization Number and an NIE, or Nomor Izin Edar, which can be translated as “distribution permit number,” both issued by the BPOM. Alphanumeric NIEs provide master product data, including where the product was manufactured, and allow verification through a database called Cek Produk BPOM (“Check BPOM Products,” roughly).

Authentication Barcodes

December 7, 2025, is the deadline for serializing and labeling narcotics and psychotropics (e.g., antipsychotics and antidepressants) with a 2D DataMatrix code. By December 7, 2027, all prescription drugs, including biological products, must be serialized and authenticated. Aggregation, following GS1 standards, is also required.

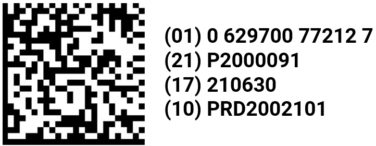

The authentication codes must contain the following information:

- A GS1 Global Trade Item Number (GTIN)

- A Marketing Authorization Number from the BPOM

- A production code or batch number

- An expiration date

- A serial number

Companies can obtain codes from the BPOM or from an independent source.

Some products/packs are exempt from the authentication requirement. These include blister packs, strip packs, pre-filled syringes, stick packs, single packaging, and catch covers.

Other Indonesia Track and Trace Regulations: Distribution

The BPOM has other requirements coming into effect between 2024 and 2026:

- December 7, 2024: Distribution centers with minimum stock keeping units (SKUs) of 1,500 serialized products must submit reports to the BPOM.

- December 7, 2025: “Second-tier” distribution centers (min. 750 serialized products) must submit reports to BPOM. Note that this coincides with the deadline for serializing and labeling narcotics and psychotropics.

- December 7, 2026: “Third-tier” distribution centers (min. 400 serialized products) must submit reports to BPOM. This applies to certain categories of pharmacies or clinics.

Electronic Leaflet Pilot (2023-2025)

A pilot for electronic leaflets (e-leaflets) began in July 2023 and is scheduled to conclude in July 2025. Wanting to transition from a paper-based system, the BPOM plans to develop a dedicated mobile app for scanning a single code (likely the mandated GS1 2D DataMatrix code) that will take users to information online. The pilot is being conducted in three phases:

- Phase I for vaccines and injections (completed)

- Phase II for prescription drugs, including vaccines and injections (completed)

- Phase III for over-the-counter and prescription drugs, including vaccines and injections (in progress)

Final Thoughts About Indonesia Track and Trace Regulations

As we said above, Indonesia is seeking to expand and open its pharmaceutical sector to foreign participation and investment. Pharma companies that already have an in-country presence or that want to enter the market must fully understand — and comply with — Indonesia track and trace regulations.

This is where we can help. Our solutions for global pharma compliance will help ensure you’re prepared for Indonesia’s requirements for product identification, serialization, and aggregation.

It’s all part of our 20-year commitment to protecting patients, combatting counterfeit drugs, and securing supply chains. Our solutions report into all global government agencies, help ensure you meet your regulatory obligations, and protect products and people everywhere you do business. Contact us today to learn how it works!