Today, we’re looking at what cosmetics supply chain transparency means, why it matters, and how cosmetic companies can achieve it through the use of technology and gain much more than just a healthier bottom line.

Cosmetics supply chain transparency vs. traceability

Cosmetics supply chain transparency means the whole supply chain is visible, from raw materials, production, and packaging to delivery to retailers and, ultimately, consumers. A lack of transparency in complex supply chains that move billions of products can cause significant risks to both consumer and product owner.

Transparency results from creating a full, shareable, fact-based profile of every aspect of the supply chain. It is a means for companies to support its claims (e.g., product provenance, sustainability, ethical sourcing) and tell the world, “We are what we say we are.” In this way, transparency is a strategic concept — one more and more cosmetic companies are adopting because of its significant benefits for operational efficiency, consumer engagement, brand protection, and profitability.

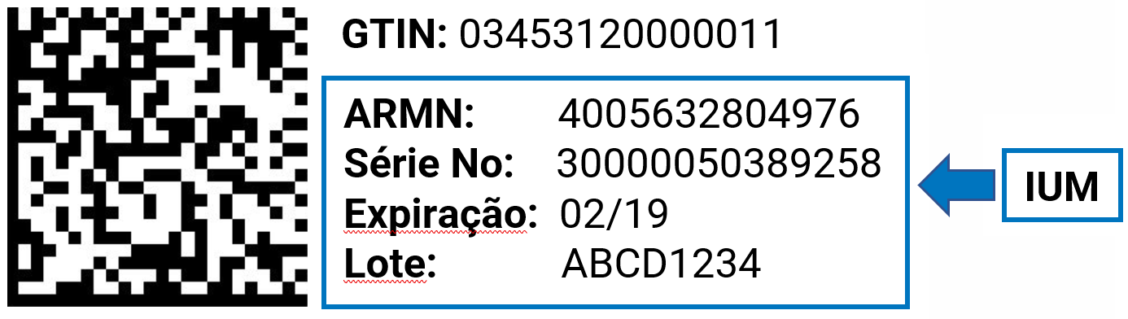

Traceability most often concerns individual products and aggregations (e.g., boxes, cartons, pallets) and observing/monitoring them as they make their way through the supply chain. It is a means to identify, follow, and verify what’s in your supply chain, as well as comply with regulations that mandate traceability through serialization and digitalization.

Cosmetics supply chain transparency for business value

It’s the global cosmetics market will grow from $287.94 billion in 2021 to $415.29 billion in 2028. Indeed, there are signs the market is booming. For example, L’Oréal, the world’s largest beauty brand, reported record profits last year, with CEO Nicolas Hieronimus, recently commenting, “2021 was a historic year for L’Oréal … Over two years, the Group achieved growth of +11.3 percent like-for-like, spectacularly outperforming a market that had returned almost to 2019 levels.”

The other leading cosmetics brands also did well in 2021. Unilever reported just over $24 billion in beauty and personal care sales, and Estée Lauder had $16.2 billion in sales, an increase of 13 percent over last year.

The “Big 3” of the cosmetics industry have something in common other than strong market performance: Each is committed to transparency and puts it front and center in their business strategy and mission. For example, L’Oréal held a virtual “Transparency Summit” last year, Unilever equates transparency with “integrity,” and Estée Lauder has a dedicated supply chain transparency page on its website.

Transparency and risk management

Despite the opportunity for growth, however, global supply chain challenges can threaten a company’s ability to satisfy growing consumer demand. We all know about the supply chain weaknesses revealed during the pandemic, including overreliance on manufacturing hubs and shipping bottlenecks, not to mention changes in consumer expectations and the way they want to buy and interact with cosmetics.

In a rapidly evolving landscape of tougher regulations, ongoing supply chain uncertainty, increased consumer expectations, and brand risk, transparency has become foundational for success.

Regulatory compliance. Cosmetics regulations vary around the world. For instance, laws in the EU are much broader than in the United States. Generally, however, companies are responsible for making sure their cosmetics are safe, properly labeled, and comply with the regulations that apply to them.

Furthermore, more and more regulatory bodies are calling for modernization via the adoption of digital technologies to ensure products are safe and that companies are able to remain compliant as regulations evolve. Cosmetics supply chain transparency (and traceability) is crucial to compliance. Read our “Global Cosmetics Market” white paper to learn more about regulations in key markets and how technology is driving the industry.

Counterfeits and fakes. And as we’ve written before, counterfeiting is a big problem for the cosmetics industry. Fake products endanger consumers’ health. They can contain toxic substances such bacteria, animal waste, and carcinogenic substances (e.g., lead).

Counterfeits and fakes also damage profits. In “Global Trade in Fakes: A Worrying Threat” (June 2021), the Organisation for Economic Co-operation and Development (OECD) reported that the global value of counterfeits and pirated goods amounted to as much as $464 billion in 2019, or 2.5 percent of world trade.

Brand reputations are also jeopardized by counterfeits. One bad (or very bad) experience can send customers to your competitors and tarnish your image, especially as consumers broadcast their opinions online. Our brand protection series talks more about counterfeits. It’s a real problem that every industry must contend with.

Diversion, theft, and gray markets. The complexity of global supply chains makes it possible for products to end up in markets where they shouldn’t be. Unauthorized or unofficial distribution channels shepherd expired, damaged, or otherwise compromised goods to unauthorized third-party sellers that consumers may think are legitimate. A product bound for Asia winds up in the United Kingdom.

Transparency is not a singular solution for these problems, but it is an indispensable facet of a coordinated, integrated supply chain management strategy to mitigate risk and create real business value.

Mainstreaming sustainability and ESG reporting

As we’ve noted, consumers are demanding more information about the products they purchase; they want to know that ingredients have been ethically sourced and are safe. They want a trust-based relationship with their brands — and if they don’t get it, they’ll happily take their business elsewhere.

This means cosmetics companies must be vigilant and forthcoming about everything in their operations, from their labor standards and how they source raw materials to packaging and other fundamentals of their supply chains. In response, environmental, social, and governance (ESG) reporting has become more prevalent.

ESG reporting measures a company’s social and environmental performance through its supply chain and operations. Cosmetics companies are under pressure, not least from consumers, to reduce their environmental and social impact, set up monitoring systems, use sustainable materials, and publish their social credentials. In this way, ESG reporting is part of cosmetics supply chain transparency.

Or, more accurately, cosmetics supply chain transparency enables effective, accurate ESG reporting.

Leading cosmetics companies are now using ESG reporting, or some form of it, as a strategic tool to monitor their success in sustainability. For example, in 2021, L’Oréal implemented “L’Oréal for the Future,” its sustainability program for 2030. Without mincing words, it prioritizes transparency in product manufacturing, transport, the sourcing and quality of ingredients, sustainability, and more:

“Our commitments towards 2030 mark the beginning of a more radical transformation and embody our view as to what a company’s vision, purpose and responsibilities should be to meet the challenges facing the world.”

Ironically, ESG has enabled some bad players to essentially fake their declarations of transparency and sustainability. It’s called “greenwashing,” when “a company purports to be environmentally conscious for marketing purposes but actually isn’t making any notable sustainability efforts.” Greenwashing is the antithesis of transparency. It’s unethical, and companies that engage in it never intend to meet or quantify their stated transparency, sustainability, and ESG claims.

We’ll be talking more about cosmetics supply chain sustainability tomorrow. Be sure to visit our blog for that.

Final thoughts

Cosmetics supply chain transparency benefits consumers and brand owners alike. For consumers, it means products are safe and legitimate, comply with regulations, and demonstrably rise to the company’s sustainability and ESG goals. For brand owners, transparency offers greater operational efficiencies, mitigates common supply chain risks, and creates opportunities to burnish their reputations, engage with consumers, and tell them with certainty that your products and processes are what you say they are.

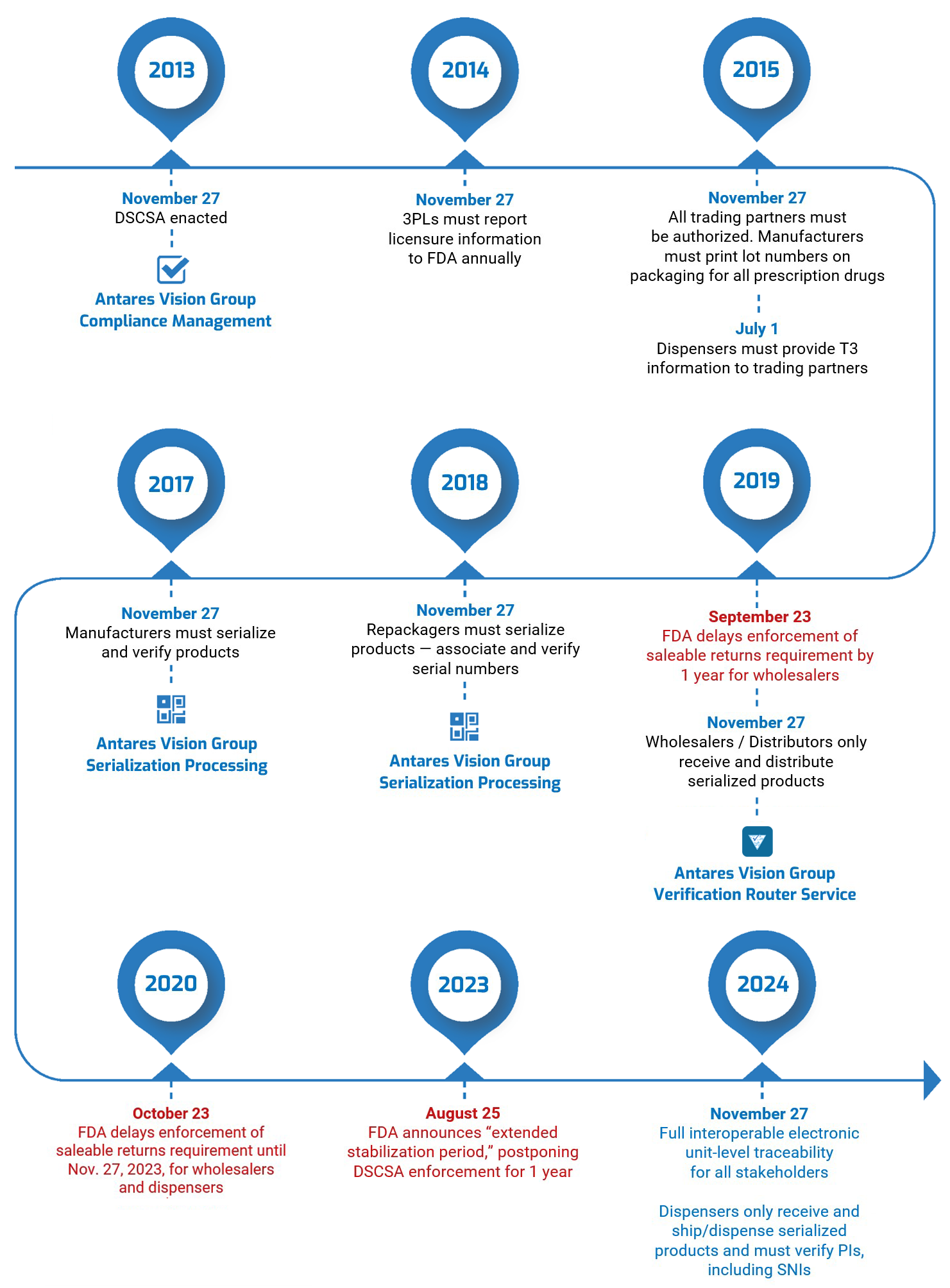

Is it difficult to attain transparency? No. Our Traceability System enables companies to follow everything in their supply chains in real time from virtually anywhere in the world. It makes every product a “digital asset” with a certified, provable, and sharable provenance. Its intuitive, scalable solutions can be used individually or as a complete platform to create transparency and end-to-end supply chain traceability and visibility. rfxcel and Antares Vision Group are committed to bringing transparency to all supply chains. We can show you how we do it in about 15 minutes, so contact us to schedule a demo.

And if you’re interested in a transparency case study of sorts, read our global seafood “Transparency Trilogy.” What’s true for seafood is true for cosmetics: Its supply chain reaches into remote areas and involves vulnerable populations and threatened resources.