There’s a deadline coming up for the UAE Tatmeen track and trace system, so we figured it was a good time to take another look at the platform that will, as the government says, “safeguard the entire supply chain.” We’re going to focus on just the facts today. For a more comprehensive look, check out the article we wrote earlier this year.

What is the UAE Tatmeen track and trace system?

“Tatmeen” means “assurance” in Arabic. The Ministry of Health and Prevention (MOHAP) introduced the system in June 2021 “to ensure protection of public health and improve the security of healthcare at all stages.” It will do this by tracking and tracing all pharmaceutical products and medical devices that enter the country.

In addition to MOHAP, three UAE-based organizations are involved in the Tatmeen system:

- The Dubai Health Authority (DHA) oversees the “complete health sector” in Dubai and promotes engagement with the private sector. Tatmeen will integrate with the DHA’s electronic medical record system and utilize its paperless drug and medical supplies management system.

- The Department of Health—Abu Dhabi is the regulative body of the healthcare sector in the Emirate of Abu Dhabi. It “shapes the regulatory framework for the health system, inspects against regulations, [and] enforce[s] standards.”

- EVOTEQ is a “digital transformation catalyst” that promotes innovation, including digitalization, particularly in public-private partnerships.

GS1 UAE is also involved, as the UAE Tatmeen track and trace system is based on GS1 standards. This includes using GS1’s BrandSync platform as a central reporting repository.

How does the UAE Tatmeen track and trace system work?

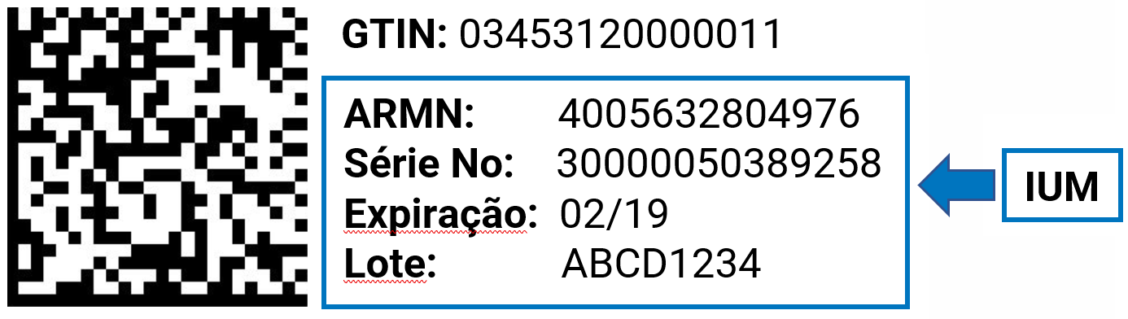

Tatmeen is structured around GS1 barcodes and scanning products as they enter the country and move through the supply chain. Explained simply, the process looks like this:

- Manufacturers put a GS1 barcode on every product. Manufacturers are responsible for aggregation. They must obtain a license from MOHAP to import “conventional, biological or other human pharmaceutical products.” As in other countries, this is a multi-step process. See the MOHAP website for more information.

- Customs officials scan products to get detailed information and verify they are legitimate before allowing them into the country.

- Distributors and logistics providers scan to keep track of inventory, provide another layer of protection, and help ensure products are delivered to the right place in a timely manner.

- Healthcare providers at hospitals, clinics, and other facilities scan to verify a product’s legitimacy and expiration date prior to dispensation.

- Patients and consumers can also scan to check the safety and authenticity of products.

Tatmeen timeline, next deadline, and news

As we noted above, MOHAP introduced the UAE Tatmeen track and trace system last June. The first deadline was Dec. 13, 2021, when manufacturers and marketing authorization holders had to be registered with the BrandSync platform and begin using 2D DataMatrix codes.

Truth be told, it’s been pretty quiet since then, with industry getting ready for the next deadline — Dec. 13, 2022 — which concerns serial number reporting, aggregation, and Global Location Numbers (GLNs). See our previous article for those details.

Several updated technical documents have been posted on the Tatmeen website this year:

- Technical Guide for Dispensers (v2.0, March 21, 2022)

- Technical Guide for Logistics (v3.0, May 30, 2022)

- Technical Guide for Manufacturers (v4.0, July 6, 2022)

The Tatmeen Serialization Implementation User Guide, “GS1 Barcoding of Conventional Medicines: An Introduction and Reference Guide,” is still in v1.0, dated Aug. 10, 2021.

One notable event was a 4-day Tatmeen workshop held this past June. Co-hosted by MOHAP and EVOTEQ, it gathered representatives from the DHA, the Department of Health–Abu Dhabi, the Emirates Health Services (EHS), and Federal Authority for Identity, Citizenship, Customs and Ports Security to discuss progress made, attracting manufacturers, and connecting stakeholders in the platform.

Speaking at the workshop, Ahmad Ali Al Dashti, assistant undersecretary for the support services sector at MOHAP, and Ali Al Ajmi, director of MOHAP’s Digital Health Department, said the UAE Tatmeen track and trace system is leveraging technology to transform the health sector and continue the country’s position as a role model for assuring the safety of pharma products, including by fighting counterfeits.

Final thoughts

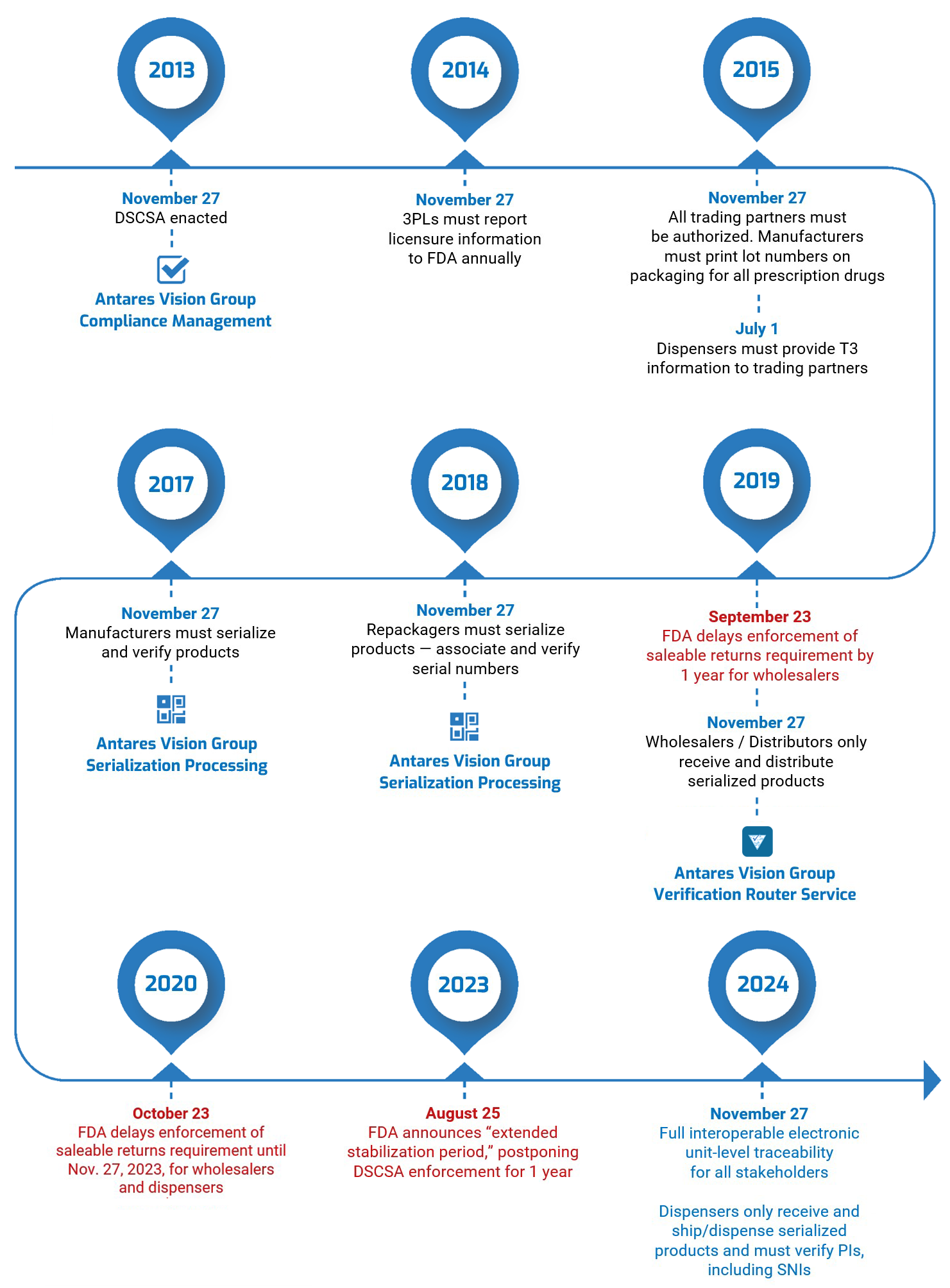

The UAE Tatmeen track and trace system is the perfect example of how the global push for pharmaceutical traceability and serialization is not slowing down. Quite the opposite, in fact.

Sure, some regulations and big deadlines get more attention than others — the U.S. Drug Supply Chain Security Act leaps to mind — but rest assured other countries are hard at work to modernize and digitalize their supply chains. A few examples that we’ve covered recently include Kazakhstan, Uzbekistan, Egypt, and The African Medicines Agency.

We’re here to help you understand the global regulatory landscape, answer your questions, and help ensure you’re able to do business everywhere you supply chain goes. In terms of the Middle East specifically, we have people on the ground implementing traceability hubs in Lebanon and the Kingdom of Bahrain; we have the know-how to make your supply chain safe, secure, and compliant while optimizing your operations and growing your business.

Contact us today to learn more. In about 15 minutes, we can show you how our automated, intuitive technologies actually make it easy to meet regulations and improve your supply chain.