If you follow our blog (and we know you do), you know that pharma stakeholders will have to verify all products at the individual package level when the Drug Supply Chain Security Act (DSCSA) goes into full effect about 1 year from now. The FDA National Drug Code, or NDC, is integral to this requirement.

At some point, however, the FDA realized that it was “running out of” National Drug Codes. One reason was the pandemic, which the Agency said “significantly increased the rate at which NDC codes were issued.” In response, on July 25 it published a proposed rule, “Revising the National Drug Code Format and Drug Label Barcode Requirements.”

What does this mean? How will a new FDA National Drug Code format affect the pharma industry? Let’s take a look.

What is the FDA National Drug Code?

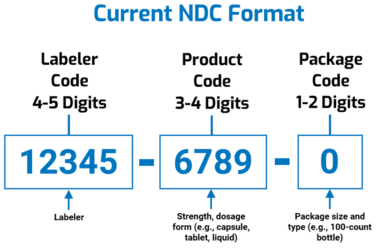

The FDA National Drug Code is the Agency’s “standard for uniquely identifying drugs marketed in the United States.” The codes are usually found on product labeling and might be part of the universal product code (UPC). Today, National Drug Codes comprise 10 digits in three segments:

-

-

- Labeler code (4 or 5 digits), which identifies the labeler. The FDA defines a labeler as “any firm that manufactures (including repackers or relabelers), or distributes (under its own name) the drug.” The FDA assigns labeler codes.

- Product code (3 or 4 digits), which identifies strength, dosage form, and formulation for a particular firm. Firms assign product codes.

- Packaging code (1 or 2 digits), which identifies the package size and type. Firms assign packaging codes.

-

National Drug Code formats are commonly referred to as “5-4-1,” “5-4-2” (HIPAA standard), “5-3-2,” or “4-4-2” depending on how many digits each segment has. The illustration below is adapted from an FDA graphic depicting the current format.

The Proposed Changes to the FDA National Drug Code

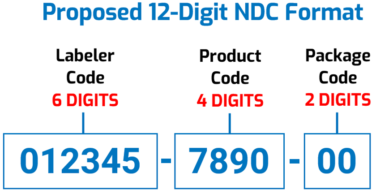

The proposed FDA National Drug Code would have a “uniform” 12-digit, “6-4-2” format, as illustrated below. The Agency says this “would facilitate the adoption of a single NDC format by all stakeholders [and] eliminate the need to convert NDCs from one of FDA’s prescribed formats to a different standardized format used by other sectors of the healthcare industry (e.g., healthcare providers and payors).”

When and how will the change be rolled out?

The FDA proposes an effective date 5 years after the final rule is published “to allow stakeholders time to develop and implement changes to their systems.” Pharma stakeholders that use FDA-assigned codes will need to have systems in place to handle the new format by the effective date.

The Agency would begin assigning new 12-digit National Drug Codes in the 6-4-2 format on the effective date. Drug listing files submitted on or after the effective date would also have to use the new 6-4-2 format.

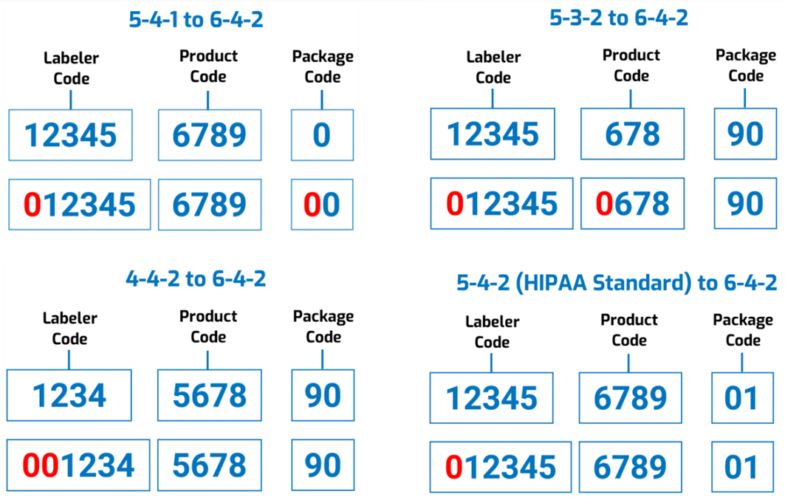

However, “to reduce the burden on registrants,” the FDA says it won’t require companies to resubmit all of their existing drug listing files; instead, the Agency itself would convert the existing codes “by adding leading zeros to the appropriate segments.” For example:

And though the Agency’s proposing a 3-year labeling transition period from the effective date, it’s encouraging manufacturers and distributors to start using the new National Drug Codes as early as possible. Still, during this 3-year period the FDA “does not intend to object to the continued use of 10-digit NDCs on the labeling of products that were assigned a 10-digit NDC prior to the effective date.”

Impact on product labeling

Product labeling will have to be updated with the uniform 12-digit FDA National Drug Code. To make this easier for stakeholders, the Agency proposes revising requirements to allow linear or nonlinear barcodes — as long as they meet mandated standards.

The FDA says it’s also looking into revising 21 CFR 201.25(c), “Bar code label requirements,” to “accommodate potential advances in technologies and standards development by allowing the use of unspecified automatic identification and data capture (AIDC) formats other than linear or non-linear barcodes … without the need to revise the regulation again.”

Industry reaction

These proposed changes to the FDA National Drug Code would affect manufacturers of human and animal drugs, insurers/payors, wholesale distributors, drug databanks, pharmacies, hospitals, small clinics and healthcare practitioners, dentist offices, prisons, nursing care facilities, importers, federal agencies using the National Drug Code, state and local governments, and other supply chain stakeholders that use FDA National Drug Codes.

The pharma industry has known for at least 4 years that the FDA was concerned about running out of codes and was thinking about proposing changes. The Agency held a public hearing on Nov. 5, 2018, “to receive input from stakeholders on how to maximize the benefit and minimize this impact well in advance of any forthcoming change.” Four options were presented at this hearing:

-

-

- Option A: Use 5-digit labeler codes until they run out, then adopt a 6-digit labeler code

- Option B: Start using 6-digit labeler codes on a designated date

- Option C: Change to an 11-digit format, then a 12-digit format, when the 5 -digit label codes are gone

- Option D: Adopt the 12-digit format before the 5-digit labeler codes are gone.

-

Most comments from industry supported Option D. “Comments were in favor of FDA’s adoption of a single standardized format that could be used by all stakeholders,” the Agency reported. “The majority of the commenters were in favor of FDA establishing a certain date when stakeholders would be required to have systems capable of handling the new format.”

However, industry leaders raised concerns in their public comments. The Healthcare Distribution Alliance (HDA) noted its “agreement with those speaking at the public meeting that … Options, A, B and C, are infeasible. Some of them, for example, would negatively impact bar code technology and interoperability, and others would perpetuate, or even exacerbate the confusion created by the current multiple formats, by adding even more formats. These three Options could also result in creating duplicate NDCs.”

GS1, with input from its New NDC Format Workgroup, advocated for Option D, including implementing “a standards-based format for NDC” (i.e., using a Global Trade Item Number, or GTIN; see below). It also noted concerns, saying this option had “cons,” including its impact on standardized numerical identifiers (SNIs). Let’s examine this a bit further.

FDA National Drug Codes will play a significant role when the DSCSA goes into full effect on Nov. 27, 2023. At that time, drug package labels must include a product identifier. A product identifier is a standardized graphic that contains the product’s SNI, a lot number, and an expiration date. The SNI comprises two data points: the National Drug Code and a unique alphanumeric serial number.

With this in mind, GS1 commented that the “SNI Guidance will need modification in advance of and as preparation for Option D implementation. The SNI guidance defined SNI as NDC + serial number. However … this does not support unique identification at every level of the packaging hierarchy, and therefore is not sufficient to support traceability. GS1 members had been able to overcome this challenge by embedding the NDC in a GTIN. However, with Option D, members will no longer have this technical mechanism.”

Final thoughts

That’s a lot to think about. The comment period for the FDA National Drug Code proposed rule ends Nov. 22, 2022, and industry stakeholders are sure to once again share their opinions in the docket. Some of the issues that could be raised include the following:

-

-

- Companies’ serialization systems and ancillary systems could be affected because they contain and use FDA National Drug Codes.

- Systems will have to accept and store both the current and new formats.

- Stakeholders will have to know which format to send and when.

- Systems may have to carry both formats simultaneously for current medicines.

-

The biggest takeaway, though, is that companies should be thinking about the change and preparing now. This is a DSCSA mantra, right? Prepare for the Verification Router Service (VRS). Prepare for ATPs. Prepare for product identification, serialization, and EPCIS.

If you have questions, contact us today to speak to one of our DSCSA and supply chain experts. We’re participating on the GS1 New NDC Format Workgroup and have been actively involved in discussions about how the changes will affect pharma companies. With only a little more than a year to go before rollout of the DCSCA is complete, now is the time to connect with us and make sure you’re going to be ready for the full serialization of the U.S. pharma supply chain.