Welcome to Part 2 of our look at the supply chain in Africa. In Part 1, we did “Africa by the numbers,” getting into the details of the continent’s geography, demographics, economy, and goals of “Agenda 2063.” Today, we’re talking about three challenges and three opportunities. There’s a lot to cover, so let’s get started.

Three challenges for the supply chain in Africa

As we said in Part 1, Africa is big: about 11.7 million square miles (30.3 million square km). The continent has eight primary physical regions — the Sahara, the Sahel, the Ethiopian Highlands, the savanna, the Swahili Coast, the rain forest, the African Great Lakes, and Southern Africa — and traversing these diverse landscapes is not always easy.

Which brings us to the first challenge for the supply chain in Africa: physical and electronic infrastructure. Stated simply, Africa has a long way to go with infrastructure. McKinsey & Company’s “Solving Africa’s infrastructure paradox” (March 2020) provides a good overview of this challenge, the paradox being that there’s a high demand for projects and sufficient capital, but not much action. Specifically,

“… infrastructure investment in Africa has been increasing steadily over the past 15 years, and … international investors have both the appetite and the funds to spend much more across the continent. The challenge, however, is that Africa’s track record in moving projects to financial close is poor: 80 percent of infrastructure projects fail at the feasibility and business-plan stage.”

One eye-opening statistic from the McKinsey article: More than two-thirds of the world’s population that does not have access to electricity lives in sub-Saharan Africa. That’s 600 million people. The challenge is self-evident. Agenda 2063 has ambitious infrastructure components (e.g., rail, air, water) and could very well smash this paradox. But it will take time.

Here are two other key challenges for the supply chain in Africa:

The informal economy. The Center for Global Development reports that Africa’s informal sector is the largest in the world, citing International Labor Organization statistics that it accounts for almost 90 percent of the economy in sub-Saharan Africa and about two-thirds in North Africa. Research from 2019 showed that the informal sector provided 90 percent of all new jobs and 70 percent of all employment across sub-Saharan Africa.

In Africa’s urban areas — the fastest-growing in the world — World Bank data shows that almost 81 percent of jobs are in the informal sector, while the International Labor Organization reported that almost 96 percent of youth ages 15-24 and a little more than 93 percent of women work in the informal economy.

This means that a significant part of the supply chain in Africa is informal, operating through non-official channels and without government oversight, regulation, or taxation. This makes it difficult for businesses to operate in Africa and enables an environment in which other supply chain problems can arise.

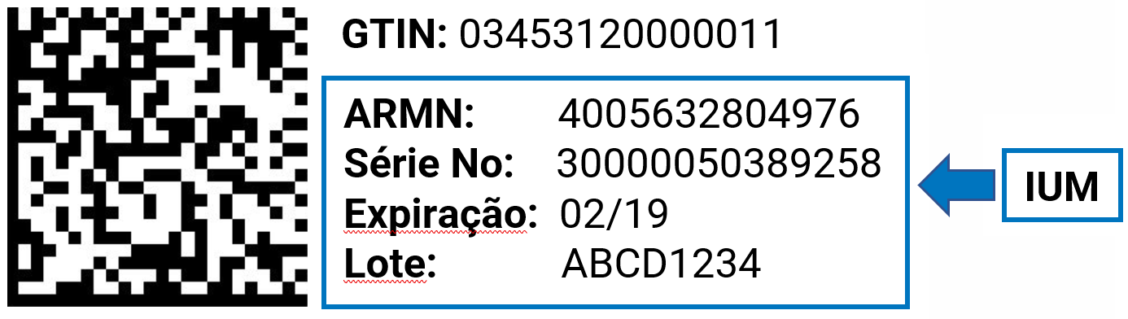

Counterfeits. Illegal copying and counterfeiting is widespread in Africa, as it is in other parts of the world with unregulated informal economies and insufficient supply chain protections. Bad actors are only too happy to exploit these conditions.

For example, 42 percent of all fake medicines reported to the World Health Organization from 2013 to 2017 came from Africa. (WHO estimates one of every 10 medical products in low- and middle-income countries is substandard or fake.) Reading between the lines, the proliferation of counterfeit medicines in Africa’s supply chain might be even greater, as weak regulations and lax enforcement often results in under reporting.

To illustrate the problem, last year an Interpol-supported operation in Southern Africa targeting “trafficking of illicit health products and other goods” nabbed 179 suspects and seized products worth approximately $3.5 million. Examples of similar events include the following:

-

- 2015-2018: Almost 20 tons of fake medicines seized in Mali

- 2017: More than 420 tons of illegal pharmaceutical products seized in seven West African countries

- 2018: 19 tons of counterfeit medicines seized in Ivory Coast, Guinea-Bissau, Liberia, and Sierra Leone

- 2019: 12 tons of counterfeit pharmaceuticals intercepted in Ghana

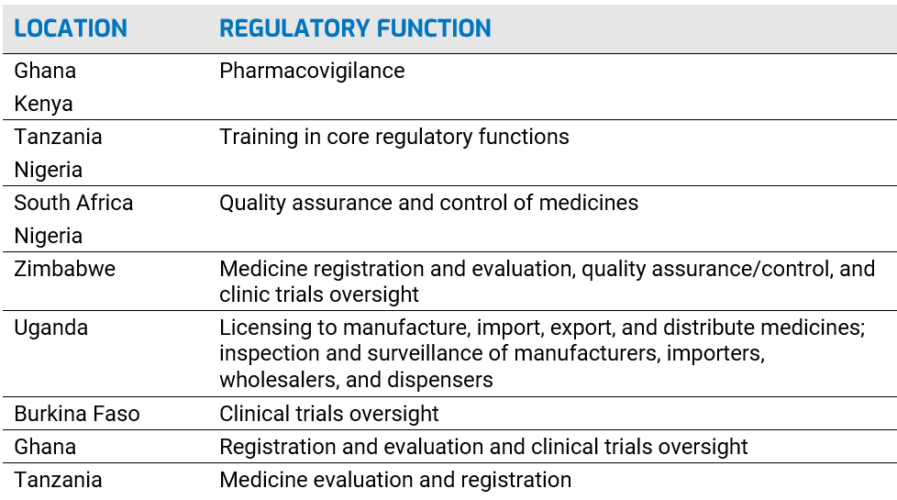

But official channels are working to address the problem, including these initiatives:

-

- The United Nations Office on Drugs and Crime announced a “holistic strategy” to combat crime and fake drugs in West and Central Africa.

- The African Union announced that the African Continental Free Trade Area (AfCFTA) Secretariat had signed a letter of intent to work with other partners to combat counterfeit trade.

- The Lomé Initiative is a binding agreement among the Republic of the Congo, Niger, Senegal, Togo, Uganda, Ghana, and the Gambia to criminalize trafficking falsified medicines.

- The legal profession is also aware of the problem.

Three opportunities for the supply chain in Africa

The rise of manufacturing. African manufacturing made headlines last month when Afrigen Biologics and Vaccines in Cape Town, South Africa, announced it had successfully copied Moderna’s COVID-19 vaccine with no input from the U.S.-based company. At about the same time, the director of the Africa Centers for Disease Control and Prevention said 10 countries were making vaccines right now or planning to do so, with South Africa, Senegal, Rwanda, Algeria, and Morocco taking leading roles.

Led by organizations such as the African Partnership for Vaccine Manufacturing and the African Vaccine Manufacturing Initiative, a coordinated push is underway to manufacture vaccines in Africa “from scratch” (i.e., not merely “filling and finishing” imported products) and make the continent “vaccine independent.”

And this is emblematic of an African manufacturing renaissance of sorts. In the second quarter of 2021, for example, United Nations’ growth estimates indicated a 17.8 percent expansion of manufacturing output. (Output had dropped by 17.1 percent during the same period in 2020, primarily attributable to the pandemic.) Also in the second quarter of 2021, manufacturing output increased “in many African countries,” including South Africa (39.3 percent), Rwanda (30.2 percent), Senegal (22.6 percent), and Nigeria (4.6 percent).

Other examples are abundant: Carmaker Nissan is opening new facilities, and analysts see Africa emerging as an auto industry hub, including for electric vehicles. Overall, research shows that manufacturing on the continent is growing, or strongly rebounding from the pandemic, especially in key economies in sub-Saharan Africa.

A healthy manufacturing sector means a supply chain with opportunities to modernize alongside production facilities, to adopt international standards (e.g., GS1) and best practices, and to build the infrastructure to secure products from the time they leave the manufacturing floor to the time they reach consumers.

A large — and young — labor force. As we noted in Part 1 of our series, approximately 1.4 billion people live in Africa (about 17 percent of the world population) and the median age is 19.7, making it the youngest continent on the planet. According to the World Bank, half of the population in Sub-Saharan Africa will be under 25 by 2050.

This could poise African countries for an employment/ongoing manufacturing boom similar to what’s happened in Vietnam, Malaysia, Singapore, Mexico, and India. With more jobs in more sectors, including technology, and more products originating on the continent, the supply chain will need to grow and adapt. This will create opportunities for modernization and synchronization with global standards and best practices.

A consumer-centric economy. Africa is an enormous market for domestically produced and imported goods and services. As AfCFTA matures and projects under Agenda 2063 and other initiatives are completed, hundreds of millions of consumers should have more and easier access to these goods and services. They should also be willing to spend more money: As of 2021, the final household consumption expenditure in Africa was a little more than $1.9 trillion; McKinsey says this could reach 2.5 trillion by 2025.

This will have a huge impact on the supply chain in Africa — for manufacturing, logistics, distribution, warehousing, and “the last mile.” The more vigorous Africa’s economy becomes, the more businesses should anticipate development of new industries, dissipation of the informal sector, increased demand for better products, and a growing “consumer class” that will come to expect the supply chain to work everywhere on the continent.

Final thoughts

The supply chain in Africa is a work in progress. Some countries, particularly those in Sub-Saharan Africa, are farther along than others. The reasons for this are diverse, ranging from stronger institutions and more stable infrastructure to fortunate geography that facilitates better access to the flow of global trade.

It’s the wise organization that follows the progress and continuously prepares to do business in Africa. This means being able to work with the supply chain, complying with regulations as they’re rolled out and refined, optimizing your systems — and finding the right solution provider.

Contact us today to speak with one of our digital supply chain experts. In just a few minutes, they’ll demonstrate how our Traceability System will ensure your business can integrate with the supply chain in Africa. After doing that, move on to the last installment of our Africa supply chain series, which highlights the pharmaceutical regulatory environment. In the meantime, think about your supply chain and consider the words of Dr. Akinwumi Ayodeji Adesina, president of the African Development Bank Group:

The future belongs inexorably to the continent of Africa. By 2050, it will have the same population as China and India do now. There will be burgeoning consumer demand from a growing middle class, a population of nearly 2 billion people, of which around 800 million young people will be looking for meaningful and sustainable employment.

If we can harness this potential by aligning supply with demand, markets with customers, and skills with jobs, and keep most of these elements and links largely within Africa, then Africa will become an unstoppable economic force, capable of feeding itself and the rest of the world for good measure. That is the future scope for Africans to shape in their own interests and for their own economic ambitions.